In the world of online retail, strike-through pricing—displaying a higher “original” price crossed out next to a lower “sale” price—is a common marketing tactic to highlight discounts and drive sales. However, when not implemented correctly, this strategy can lead to legal claims from consumer protection law firms like Pacific Trial Attorneys, Tauler Smith LLP, and others. This article outlines practical strategies businesses can use to defend against similar lawsuits.

Understanding A Typical Lawsuit

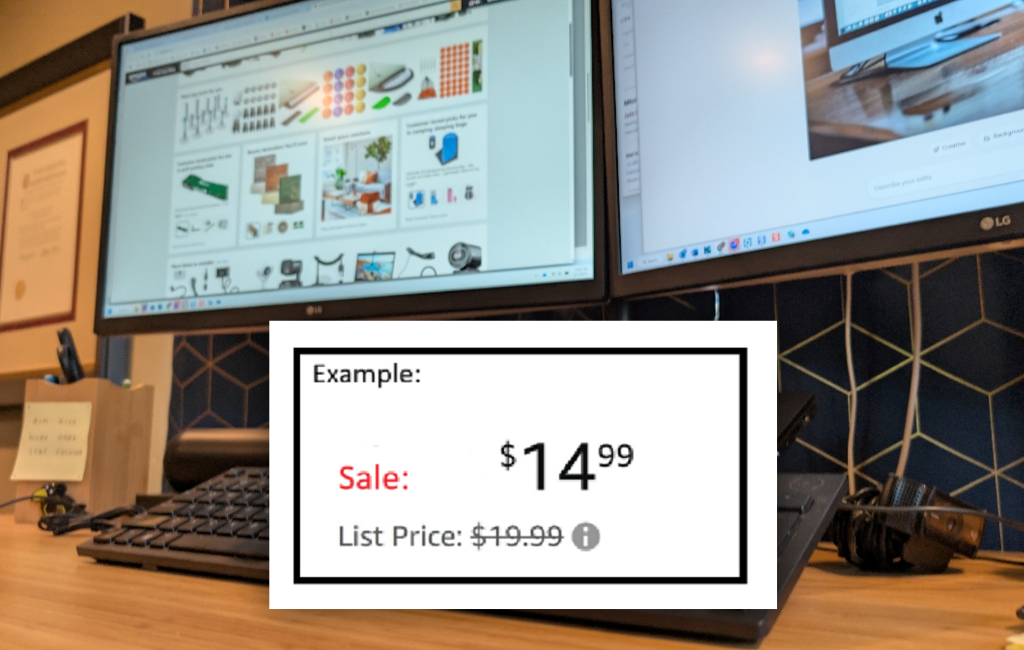

A typical lawsuit or complaint letter centers on the plaintiff’s purchase of a given item advertised at a lower price with a higher strike-through reference price. The plaintiff will claim this reference price was not the “prevailing market price” within the three months prior to the advertisement, nor was the date when it prevailed clearly stated, rendering the discount misleading. The lawsuit seeks damages, restitution, and injunctive relief for a class of California consumers who purchased products at with inflated reference prices.

The legal claims are grounded in:

- Cal. Bus. & Prof. Code § 17501: Prohibits advertising a former price unless it was the prevailing market price within the three months preceding the advertisement or the date it prevailed is clearly disclosed.

- Consumers Legal Remedies Act (CLRA), Cal. Civil Code § 1770(a)(13): Bans false or misleading statements about the existence or amount of price reductions.

Potential Defenses

Businesses facing a strike-through pricing lawsuit can explore the following defense strategies:

- Compliance with § 17501

-

- Prevailing Market Price: Demonstrate that the reference price was the prevailing market price—defined as the price at which a substantial number of retailers in the same trade area sold or offered the product—within the three months before the advertisement. Sales data or industry reports can bolster this argument.

- Clear Disclosure: If the reference price was not the prevailing market price, prove that the advertisement clearly, exactly, and conspicuously stated the date when it did prevail. For example, a disclaimer like “Price as of [specific date]” could satisfy this requirement.

- Evidence: Collect records such as invoices, historical pricing data, or third-party market analyses to substantiate the reference price’s legitimacy.

- Challenging the Plaintiff’s Evidence

-

- Monitoring Methodology: Scrutinize the plaintiff’s evidence, such as how their counsel monitored prices. If the method (e.g., periodic snapshots or automated tools) missed instances where the product was sold at the reference price, this could undermine their claim.

- Partial Compliance: Argue that the product was offered at the reference price at least occasionally within the three-month window, though courts may interpret “prevailing” to mean the most common price, making this a weaker defense unless supported by robust data.

- Reasonable Consumer Standard

-

- Non-Deceptive Perception: Assert that a reasonable consumer would not find the pricing deceptive. For instance, if the discount remained significant or the product’s unique features justified the pricing, this could mitigate perceptions of deceit.

- Class Certification Challenges

-

- Individual Issues: Argue that individual questions—such as whether each class member relied on the reference price or suffered harm—outweigh common issues. While California courts often favor class treatment in false advertising cases due to uniform practices, highlighting variations in consumer behavior might disrupt certification.

- Ascertainability: If sales records are incomplete or unclear, contend that identifying class members is impractical.

- Nature of the Reference Price

-

- Comparison Price: If the strike-through price was intended as a comparison (e.g., Manufacturer’s Suggested Retail Price or “compare at” value) rather than a former price, and this was clearly labeled or conveyed to customers, you can argue it was not misleading.

- Disclaimers: Point to any explanatory text or fine print in the advertisement that defines the reference price’s basis, reducing the likelihood of consumer confusion.

- Industry Standards and Good Faith

-

- Industry Norms: Show that the pricing aligns with standard retail practices, potentially supported by expert testimony or trade association guidelines. While § 17501 is strict, demonstrating industry conformity might sway courts or settlement negotiations.

- Good Faith: Claim a reasonable belief that the reference price was accurate, though the statute’s objective standard limits this defense’s effectiveness on its own.

- Limiting Liability

-

- Narrow Scope: Move to restrict the class definition (e.g., to specific products or a shorter time frame) to reduce potential damages. For instance, exclude transactions where the reference price was accurate.

- Ceased Practices: If the defendant has stopped the challenged pricing, argue that injunctive relief is unnecessary.

- Settlement Considerations

-

- Early Resolution: Given the high costs and reputational risks of class action litigation, explore settlement options like refunds, price adjustments, or policy changes. This pragmatic approach can cap exposure, especially with a potentially large class and attorneys’ fees at stake under the CLRA.

Conclusion

Strike-through pricing lawsuits pose significant challenges for retailers, particularly under California’s consumer protection framework. Defending against such claims requires a thorough understanding of the law, robust evidence, and strategic arguments tailored to the case’s specifics. Businesses can strengthen their position by proactively ensuring compliance—maintaining accurate pricing records, auditing advertisements, and clearly disclosing reference price bases. While defenses like proving market price compliance or challenging evidence offer hope, the strictness of § 17501 and the CLRA’s consumer-friendly provisions often make settlement an attractive option. Ultimately, prevention through transparent pricing is the best defense against these legal pitfalls.

For legal counsel with a strike-through pricing claim, please contact Stuart Tubis, Esq. at skt@jmbm.com or 415-984-9622.

ADA Compliance and Defense Blog

ADA Compliance and Defense Blog